The Business Is Thriving, But You’re Exhausted — Is It Time to Let Go?

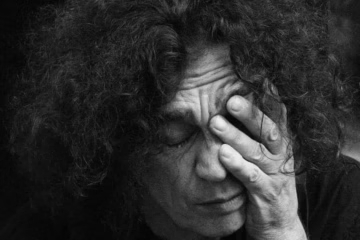

You built this business from the ground up. You poured in your time, energy, and soul. And now… it’s thriving. But here’s the problem: you’re exhausted. Not just tired—trapped. The business that once gave you freedom now feels like a cage. The long hours, constant firefighting, and never-ending decisions weigh on you. Yet, the thought of stepping back? That stirs up something deeper—guilt. “If I leave, will everything fall apart?”“What will Read more…